- #IRS 2021 TAX BRACKETS MARRIED FILING JOINTLY CODE#

- #IRS 2021 TAX BRACKETS MARRIED FILING JOINTLY TRIAL#

#IRS 2021 TAX BRACKETS MARRIED FILING JOINTLY TRIAL#

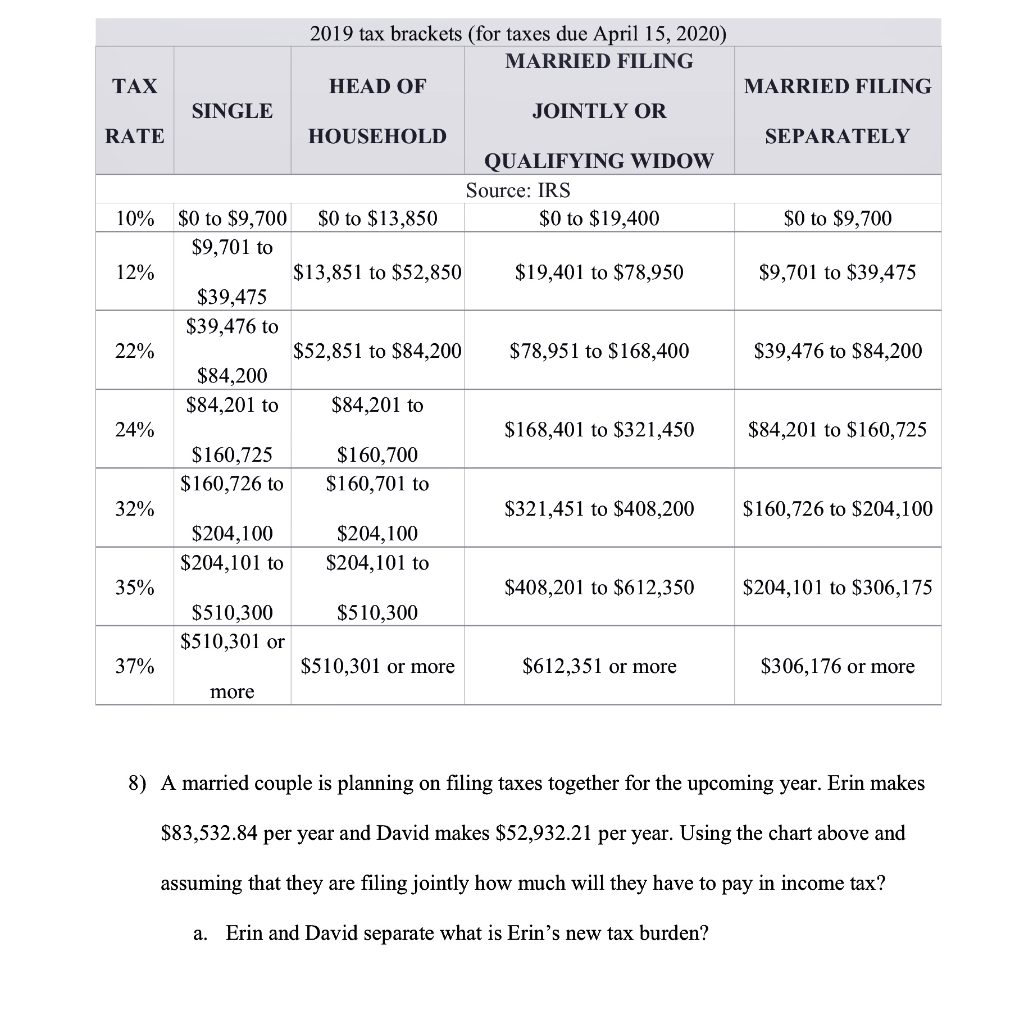

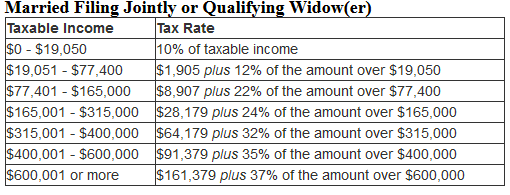

This trial is absolutely free and there are no strings attached.ġ Rev. You'll get a no-obligation 7-day FREE trial during which you can read all of our helpful tax saving tips from the last two months. If you are not yet a subscriber, CLICK HERE. If you're already a subscriber to the Tax Reduction Letter, you will be prompted to log in when you CLICK HERE. If you can find $10,000 in new deductions, you pocket $2,400. That puts the two of you in the 24 percent federal income tax bracket. Getting tax forms, instructions, and publications. Volunteer Income Tax Assistance and Tax Counseling for the Elderly. You and your spouse have taxable income of $210,000. Publication 554 - Introductory Material Future Developments Whats New Reminders Introduction Return preparation assistance. Why? That’s where you start to pocket cash when you find a new or additional tax deduction.Įxample: You are married. When looking at your federal income tax bracket, pay attention first to your last bracket. tax credit schedules to support the tax credits claimed on the SC1040TC.

#IRS 2021 TAX BRACKETS MARRIED FILING JOINTLY CODE#

$84,496.75 plus 37% of the excess over $314,150 Carolina conforms to the Internal Revenue Code as of December 31, 2021. 2022 tax table: married, filing jointly 2022 tax table: married, filing separately 2022 tax table: head of household Tax brackets 2023 For the 2023 tax year, there are seven. Married Individuals Filing Separate Returns Unmarried Individuals (other than surviving spouses and heads of households) Income over 99,950 Married filing separately. Income over 199,900 Joint Returns, individual returns, estates and trusts.

For high-income taxpayers, however, a 28 tax is applied to income in excess of the following amounts. $95,686 plus 35% of the excess over $418,850 Normally, AMT is taxed at a flat rate of 26. Married Individuals Filing Joint Returns, & Surviving Spouses are married and file a separate tax return, you probably will pay taxes on your benefits.Find out your 2021 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate returns, and estates and trusts.more than $44,000, up to 85 percent of your benefits may be taxable.In 2023, the 28 percent AMT rate applies to excess AMTI of 220,700 for all taxpayers (110,350 for married couples filing separate returns).

The AMT exemption amount for 2023 is 81,300 for singles and 126,500 for married couples filing jointly (Table 3).

0 kommentar(er)

0 kommentar(er)